Less than one tenth of one percent of our population is holding a sum of wealth approaching three times the size of the US economy that is anticipated to more than double within the next decade, the earnings on which does not contribute to Medicare, Medicaid and Social Security. And the wealthiest in America quintupled their income during the heart of the Great Recession. To propose cuts to food stamps and unemployment benefits for the victims of the Great Recession during a time of increasing poverty and poverty-related deaths, without shared sacrifice at the top, represents nothing less than a moral crisis for our country.

Since 2009 there has been no attempt to raise taxes on 98-99% of America; in fact, tax breaks have been issued to Middle America (ref). The battle regarding increasing revenue has been about closing tax loopholes and reinstating progressive tax rates on the wealthiest of Americans, generally the top 1% of income earners, the only class that has done well, and quite well, during this economic downturn. That is where the debate lies. That is where the GOP is digging in its heals.

Warren Buffet, the second wealthiest individual in America behind Bill Gates (ref), has advocated over the past several years to raise taxes on the wealthiest of Americans. Using himself as an example, he paid 17.4% on his taxable income last year (around $40 million), a lower level than any of the other 20 individuals in his office (range 33% to 41%, average 36%). The reason for this is that the “mega-rich pay income taxes at a rate of 15 percent on most of the earnings but pay practically nothing in payroll taxes. It’s a different story for the middle class; typically they fall into the 15% and 25% income brackets, and then are hit with heavy payroll taxes to boot” (ref).

It didn’t used to be like that. In 1976-77 capital gains rates were 39.9%; today they are just 15%. The tax rate on the highest levels of income following WWII during Eisenhower (90%), then Kennedy (70%) until Reagan where it was reduced to 28%, now stands at 35% following the G.W. Bush tax cuts. And these unfunded tax cuts, heavily weighted to the wealthy, have contributed to a growing income and wealth inequality (ref) as well as consistently increasing our national debt at a rate faster than the growth of our economy.

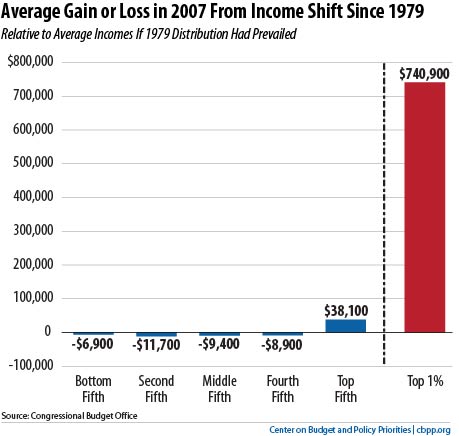

As more income has been pushed to the top over the past 30 years, the income growth of the middle class, and thus its purchasing power, has not kept pace with the growth of the economy. Quintile by quintile, the lower 80 percent of America is down almost $10,000/yr in income distribution since 1979 while the upper 1% is up over $740,000 in average income during that same timeframe. And with an economy that is 70% personal consumption, this has resulted in weaker demand for goods and services and thus slow recovery and higher unemployment (ref).

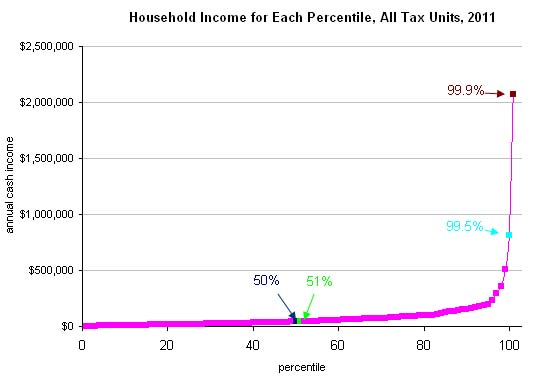

But graphs and charts do a disservice in showing what is really happening with wealth and income inequality in America. The actual dollar increases in income and wealth in recent years within the top 0.1% of income earners, as well as the rapidly growing sums of money held within that group, are mind-staggering; perhaps obscene is a better word during these economically troubled times. And that will be thrust of this article. It will compare and contrast increases in wealth and income at the top versus the extent and effects of growing poverty (including death) and unemployment in the rest of America. The failure to share sacrifice at the top while pursuing cuts in programs benefitting the victims of the recession, represents nothing less than a moral crisis for our country.

Millionaire households, that represent less than a tenth of a percent (0.076%) of the US population, hold $38.6 Trillion in wealth that is anticipated to increase 225% within the next decade to $87.1 Trillion (ref)

And those figures may actually be underestimated due to holdings in off-shore tax havens (ref). How much money is $38.6 Trillion? Less than one tenth of one percent of our population is holding wealth that is approaching three times the size of the entire US economy (GDP). It is almost three times as great as our Gross National Debt. And it is income producing and builds upon itself. Consider that almost half (49.7%) of investment assets (financial securities, stocks, mutual funds, etc) are held within the top 1% of income earners (ref). The capital gains and dividends produced by these investment assets are taxed at only 15% and are not subject to payroll taxes that contribute to Social Security, Medicare and Medicaid. With ‘money making money’ at historically low tax rates, the wealth of millionaire households is anticipated to reach $87.1 Trillion within the next decade.

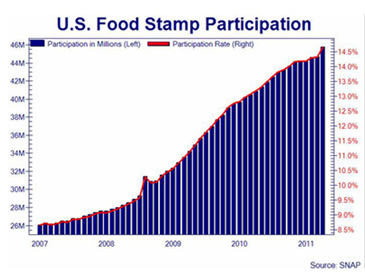

While refusing to let the unfunded Bush era tax cuts for the wealthiest expire or close tax loopholes, a Republican House proposal would cut funding for the food stamp program as part of its austerity measures. The total cost of this program last year was $65 billion (just 0.17% of the wealth held by millionaire households) and helped feed 45 million needy Americans (ref).

Since the Great Recession there has been a marked increase in Food Stamp participation. Currently 45.8 million people rely on them and that is anticipated to increase by an additional 22.5 million individuals bringing the total to over 68 million needy citizens.

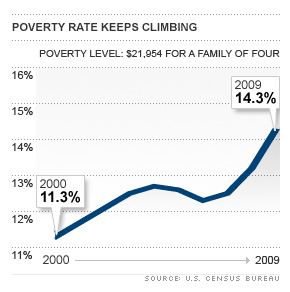

This reliance on food stamps parallels the escalation in poverty (ref). The most current census estimates have 43.6 million Americans, 14.3% of our population, living in poverty in 2009. However, a recent study by the National Academy of Science places the figure at almost 53 million. Using the census figures, 15.5 million of these individuals were children (1 child out of every 5). The poverty rate amongst children increased 28% since 2000, and jumped 10% from 2008-2009 during the heart of the Great Recession. Every day in America 2,573 babies are born into poverty (ref).

This reliance on food stamps parallels the escalation in poverty (ref). The most current census estimates have 43.6 million Americans, 14.3% of our population, living in poverty in 2009. However, a recent study by the National Academy of Science places the figure at almost 53 million. Using the census figures, 15.5 million of these individuals were children (1 child out of every 5). The poverty rate amongst children increased 28% since 2000, and jumped 10% from 2008-2009 during the heart of the Great Recession. Every day in America 2,573 babies are born into poverty (ref).

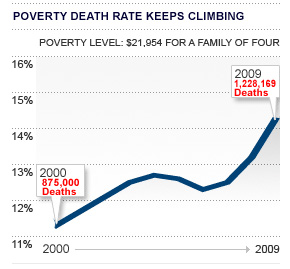

Columbia University’s School of Public Health conducted an examination of mortality and medical data and estimated that in 2000 875,000 deaths could be attributed to a cluster of social factors bound up with poverty and income inequality (ref). Applying that rate to the current number of Americans living in poverty an estimated 1,228,169 Americans died in 2009 from the effects of poverty and income inequality (ref).

Columbia University’s School of Public Health conducted an examination of mortality and medical data and estimated that in 2000 875,000 deaths could be attributed to a cluster of social factors bound up with poverty and income inequality (ref). Applying that rate to the current number of Americans living in poverty an estimated 1,228,169 Americans died in 2009 from the effects of poverty and income inequality (ref).

Who uses the food stamp program? About half the recipients are children, 8% are the elderly, 41% have incomes half the poverty level or less, and 18% have no income at all. The average family using food stamps has only $101 in savings or valuables (ref). The growing number of these individuals represent the victims of the recession. I submit that cutting benefits to the impoverished, the hungry, during economically difficult times while retaining historically low tax rates for the wealthiest, is morally corrupt and a statement of values that we as Americans should not tolerate.

The highest earners in America (74 of them with $50+ million in income) quintupled their pay in 2009, averaging $518.8 million in income ($10 million/week), and made as much income as the lowest paid 19 million workers in America combined (ref) (ref) (ref)

While 68 million Americans are relying on food stamps to feed themselves, and with wages declining for 90% of America, those earning the highest incomes in our country increased their income 5-fold during the heart of the Great Recession. These 74 individuals alone made more money than the lowest paid 19 million American workers combined.

Both Eric Cantor (ref) and Michelle Bachmann (ref) have stated that they do not support extending unemployment benefits for those who find themselves out of work as a result of the economic downturn. Ms. Bachmann’s position is that “We don’t have the money”.

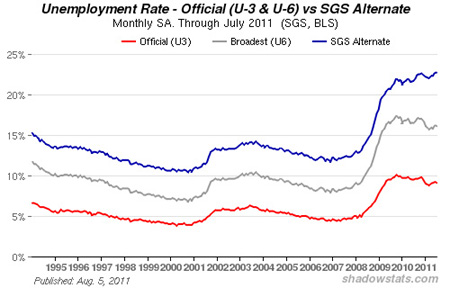

There has been a marked increase in unemployment following the Great Recession as noted in the following graph (ref). The U3 is the official monthly headline number. The U6 is the Bureau of Labor Statistics broadest unemployment measure including short-term discouraged, other marginally-attached workers, and those forced to work part time because of lack of full-time employment. The SGS Alternative (ref) is an aggregate of U3 and U6 and additonally includes long-term discouraged workers ‘who are unemployed and want to work, but have not looked for work within the past year’. These individuals were excluded from the official count in the 1990’s. The SGS gives an unemployment rate of 22.5%, an all time record of 34 million people currently in need of work.

Without unemployment benefits, more individuals, including children, would be driven into poverty and its consequences including an increase in poverty-related deaths. For Ms. Bachmann to state that “We don’t have the money” to extend unemployment benefits while supporting historically low tax rates benefitting the wealthiest is unconscionable. To let unemployment benefits expire for the victims of this recession would be placing a higher value on tax benefits for the wealthiest over the lives of US citizens, both adults and children. And regrettably this is not the first time I have made this argument regarding policy decisions on the Right (ref).

Retaining Tax Benefits for the Wealthiest While Cutting Safety Nets: A Few Other Statistics (ref)

- The richest 400 Americans hold more wealth than 154 million Americans, half the US population. They paid 30% of their income in taxes in 1995, but only 18% now.

- The average millionaire saves $136,000/year due to reduced taxes, a sum greater than the highest income level in the lower 80% of America (and, by definition, there are no taxes paid on those savings).

- One percent of America holds 40% of this country’s wealth, more than the lower 90% of America combined, and holds almost half of all investment assets that produce income at lower tax rates without payroll taxes that contribute to Social Security, Medicare, and Medicaid.

- Between 1975-2010, income of the top 0.1% of income earners quadrupled and for the top 0.01% quintupled. During this same time period worker productivity increased 80%, and yet the income shift has resulted in a shortfall of $400/week for the typical American family.

- From 2009 – Q4 2010, 88% of income growth went to corporate profits (i.e. CEOs) while just 1% went to workers.

Discussion

For those who choose to construe the above as an ‘attack on the rich’, I write from the perspective of having been there. As I explained in an open letter to Senator McConnell and Congressman Boehner when they threatened to let benefits to the vulnerable expire unless tax cuts for the wealthiest were extended (ref), my views are shaped from having lived during my adult life at income levels that define poverty, the middle class and the wealthy. I’ve never forgotten that surprise EITC check in the mail during a particularly lean year living on one income ($4500/yr and a student loan with child having medical needs and no insurance). It meant alot and I never forgot that helping hand our government extended to me as I later went on to provide employment to others. I had no problem what-so-ever during the Clinton surtax years in paying that additional 3.6% on upper income (wow, that was a real back breaker) into the system to keep it well; the same system that lent a helping hand to me when I needed it and the same system that later allowed me to do well. It is a sense of obligation. And it is worth noting that the redistribution during the Clinton years contributed to 7 million fewer Americans living in poverty (ref).

The unfunded tax cuts did not stimulate economic growth, employment, or capital investment in America as was promised (ref) (ref). And the current tax system is, frankly, grossly unfair to the middle class and damaging to our economy. When the wealthiest in our nation proportionately pay a smaller share of their total income in taxes than the middle class (this includes 1470 individuals who earned $1 million or more in 2009 and yet paid no taxes, ref) and when the tax system helps income and wealth accumulate at the top at the expense of our economic engine, the middle class (ref) Mr. Buffett is right when he said in 2006: “There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning” (ref).

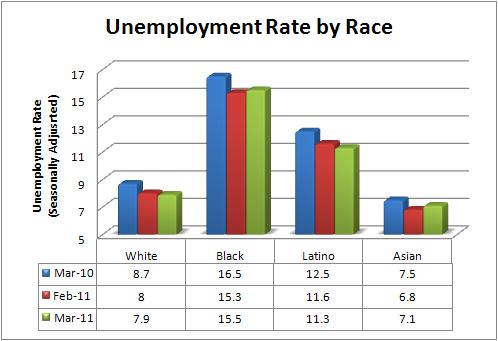

But the real consequences of what is going on in America today is being sanitized; we’re not seeing the face of poverty on TV with well dressed and well fed commentators and guests debating the issue. This is not dissimilar to the coverage of the Iraq War by mainstream media. As was detailed in the documentary, Independent Intervention, what we saw in our living rooms were the bomb explosions of Shock and Awe, not the consequences of those explosions on women and children as was graphically shown in the documentary; something the filmmakers claim would have affected public opinion on that war. And rarely do we hear about the racial component of the inequality where the March unemployment rate (seasonally adjusted) was 7.9%, 15.5%, and 11.3% for American whites, blacks and hispanics, respectively (ref).

There are real life consequences to poverty and there is no denying that one of the consequences is that it claims lives. And when cuts to safety nets are being threatened for the victims of this Great Recession while historically low tax rates are being maintained for the wealthiest, a higher value is being placed on those tax benefits than human life itself.

I submit that this represents a moral crisis for our country. Representative Bachmann and others may claim that we do not have the money to pay for those unemployment benefits, but they should first increase revenue by reducing the gap between what the wealthy and middle class proportionately pay into the system. Yes, Ms. Bachmann, it is good that people get to keep their money, but the rich are proportionately getting to keep more of theirs than the middle class.

Why is this happening? It is difficult to deny that part of it is that our politicians now are beholden to a different ‘person’ than the general public to retain their job. It is a person in the form of corporations and special interests that can contribute unlimited sums to political campaigns and sway public opinion through expensive media blitzes (ref).

In 2009, Texas Governor Rick Perry described the expansion of unemployment benefits under the stimulus plan to thousands of low-wage workers as burdening tax payers with “higher taxes and expanded obligations” (ref), and his Texas tax laws actually “redistribute income away from ordinary families and towards the richest Texans” (ref). Regarding his recent Christian Prayer event in Houston that was billed as an attempt to reverse America’s national decline (ref), I wonder if Proverbs 22:16 was included in the prayer list: “He who oppresses the poor to increase his wealth and he who gives gifts to the rich – both come to poverty”.

For the past year we have heard different politicians and pundits making comments that indicate we have lost our moral compass. This article discusses the resulting impacts of policies when we continually focus on cuts without looking at increasing revenues. In my opinion it is the policies described in this article that truly represent a moral crisis in our country. And one we should all be concerned about.

LikeLike

I have now read this .. slowly .. four times. I think it is awesome, if you will please forgive the colloquialism.

Not only is this immoral, it’s just plain stupid to think you can run a society this poorly and unjustly and not have it blow up. Physical force against those of us who have better vision for society can not take away what we know; we are all ONE and the body politic can not absorb this much unhealthy distribution.

Please keep up the magnificient work, please.

LikeLike

although i agree with some of your comments, your leftist view is clouding your vizion. you are overlooking the responsibility of the person in the white house to spend only what we have not what we think we should have. if we spent like they spend we would be behind bars. i also feel that your views on taxing the rich more than anyone else is flawed. we fight everyday for equility in this country and here people like your want to change this to fit your veiw of whats equal. in closing i would like to point out that responsibility starts with you. dont overlook things just because you like the person in office. maybe its time we give less overseas until we fix whats happening here at home.

LikeLike